Disruption And The Stock Price

A case study of the stock market behavior during BlackBerry's fall, and potential lessons for investors in stocks threatened by disruption

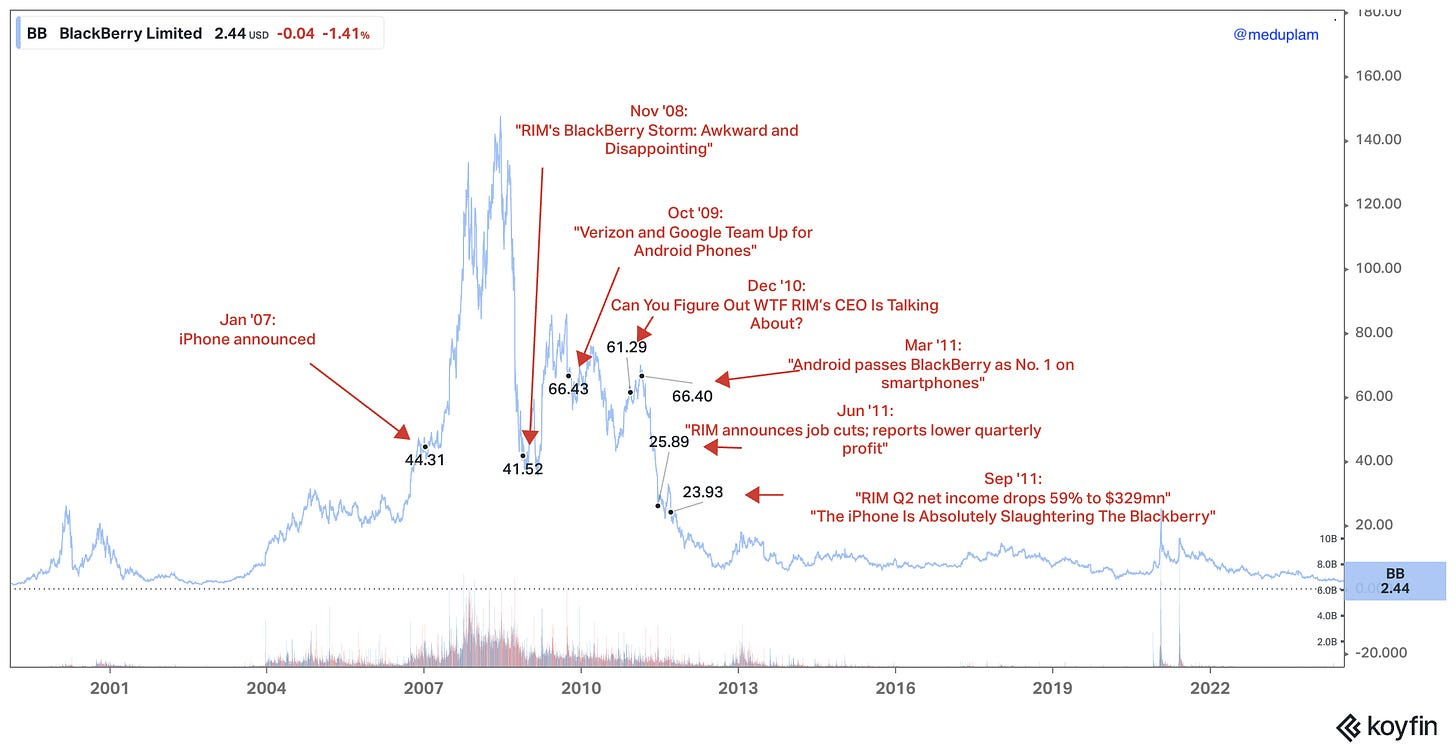

The iPhone has effectively led to BlackBerry’s rapid fall; and yet, an investor could have bought BB stock the day Steve Jobs announced the iPhone, and still have made a decent return by selling four years later. It took five years for BlackBerry’s stock to collapse.

It’s remarkable how poor the stock market can be at analyzing the mechanics of disruption; even in cases that seem obvious in hindsight, it takes time for stock prices to properly reflect the new reality. The stock price of RIM – the BlackBerry maker – was extremely volatile for 4.5 years after the iPhone arrived on the scene1, but only collapsed when the signs of disruption2 made their way into the financial statements.

Since ChatGPT took off in November of 2022, investors eagerly look for signs of Google Search disruption, with every quarterly earnings report; it would be interesting to examine the stock market reaction during a past case of technology obsoletion. This is by no means an exhaustive study (just data of size 1!), but what makes BlackBerry a great case study is how strong the product position was before the iPhone – popularized by public figures such as Oprah3 and President Obama4, – and how quick the fall was.

Disruption Confusion

“Today Apple is going to reinvent the phone,” announced Steve Jobs on January 9, 2007; the price of Research In Motion (RIM) stock – manufacturer of BlackBerry, the phone that Steve Jobs was about to make obsolete – dropped 8% that day, to $43.26. The next day, ABC News interviewed the president of a technology consulting firm, predicting that “the Apple iPhone will eclipse the BlackBerry device in cell phone market share within the year.”

The concerns were quickly brushed off, however, with the rapid growth in profits; RIM’s stock soared over 164% during 2007 – as sales of BlackBerry were gaining traction overseas – closing the year at $113.40 per share, reflecting a 59.53 price-to-earnings ratio.

The BlackBerry Storm – RIM’s confused attempt at building an iPhone-like device, under pressure from its partner carrier Verizon – was launched in November of 2008. When PC Magazine declared it “awkward and disappointing”, RIM’s stock dropped to $41.52. But the drop was more likely due to the 2008 financial crash that began in September.

Over a million Storm units were sold during the 2008 holiday season. It did help that Verizon greased it with generous subsidies, bringing the Storm price down to $200, half the price of an iPhone. But, eventually, the customers actually tried using their phones. The painful story is that RIM, blindsided by the iPhone, couldn’t choose between its original product roadmap – which included the famous BlackBerry keyboard – and the new touch screen approach; so it chose both. The Storm had a touch screen, made of glass, layered on top of a physical keyboard. Yes. It performed so poorly that David Pogue of the New York Times described the experience of typing with the Storm as "head-bangingly frustrating." So thought everyone else who bought the Storm, as almost a million units were returned by spring5.

The Verizon executives were furious; Jim Balsillie, RIM co-CEO, had promised to fix everything with the next model – the Storm 2 – but Verizon had a different plan. In order to keep up with AT&T – who held the 4-year exclusive rights for selling iPhones – Verizon was looking for a different partner. In October 2009, Verizon announced its new flagship phone: the Droid, based on Google’s Android operating system. RIM stock fell on the news, but from an elevated price following the 2009 market recovery rally. Shares were still trading for $66.43, ~50% higher than they were when the iPhone was announced almost 3 years earlier.

It’s quite astonishing. Stratechery wasn’t yet created in 2009, but if it had existed – I imagine Ben Thompson would have probably declared that the BlackBerry was doomed at this point. And yet, our slow-to-react investor, who had been holding RIM shares since the iPhone announcement, could still sell them for a nice gain. Even though it should have been clear at this point that BlackBerry had in fact lost.

Disruption and the Financial Statements

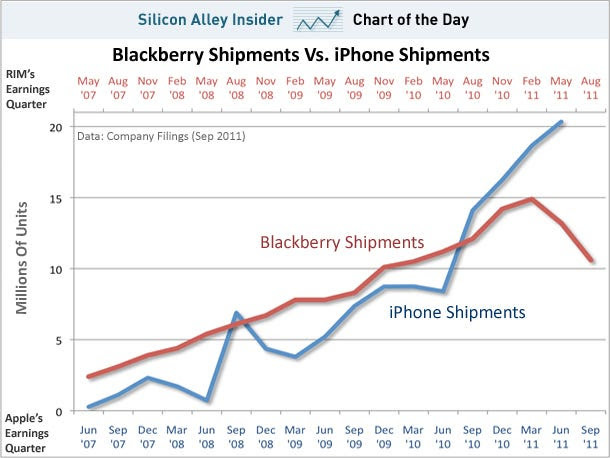

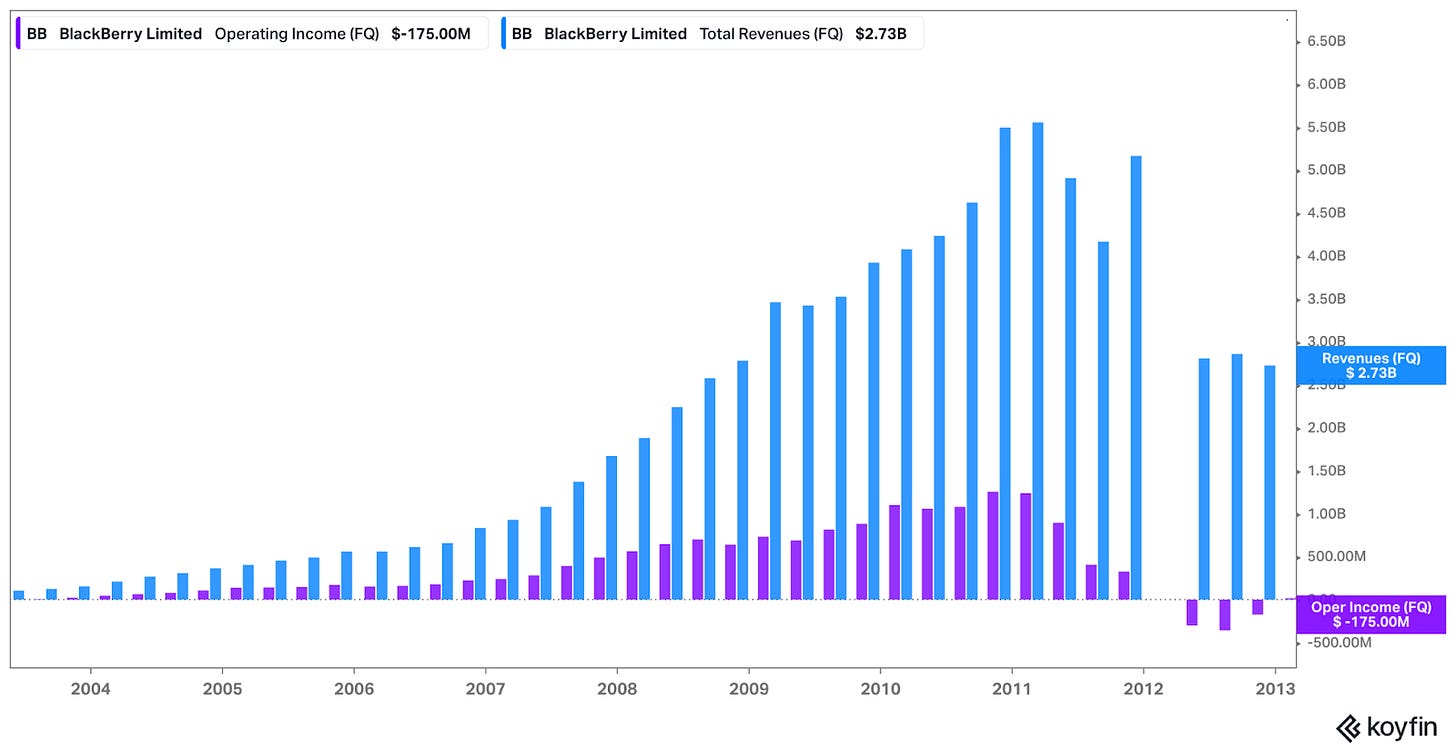

While the January 2007 debut of the iPhone had set in motion the chain of events leading up to BlackBerry’s eventual fall, the financial statements haven’t reflected any of that.

While Android was taking over BlackBerry's US market share during 2010, BlackBerry itself was still growing overseas. The reason being that Apple and the early Android makers had started with the US market, before expanding internationally. 4G cellular networks launched in the US in June of 2010, and as RIM opted out of developing a 4G BlackBerry phone (in yet another incredible story about how Mike Lazaridis refused to accept the new reality), it was quickly losing market share. It was only a matter of time before 4G networks were going to be built across the globe, ushering a wave of iPhone and Android devices that would wipe out BlackBerry’s customer base. Yet, RIM’s stock approached $70 toward the end of 2010.

In December 2010, Kara Swisher and Walt Mossberg interviewed Lazaridis. A title of a blog post – Can You Figure Out WTF RIM’s CEO Is Talking About? – did a good job catpruing the general impression. It was clear Lazaridis was out of touch with the new competitive reality. Would you continue holding shares after this interview? RIM’s stock held up above $60.

The stock rose above $70 in February of 2011, despite reports about Android taking over BlackBerry’s position as the best-selling phone. RIM stock was sliding in April of 2011, but still closed May at $42.85, slightly above its price on the January 2007 iPhone announcement. This was the last chance to come out ahead, as June brought announcements about declining profits and layoffs at RIM. The stock started tanking. The collapse was completed in September, as RIM reported a 59% decline in net income. The iPhone Is Absolutely Slaughtering The BlackBerry, reported Business Insider on 9/16/2011.

The Wile E. Coyote Moment

There were tweets looking for signs of disruption for Google Search, as early as Q1 of 2023. I find that highly amusing. Disruption just doesn’t happen in such short timeframes. It is interesting that an investor who bought Google stock the day ChatGPT was launched, has earned roughly 70% on their investment in the two and a half years since.

ChatGPT may very well end up slaughtering Google Search, and still – Google Search revenue would continue to climb for a couple more years before that happens. It may seem confusing – as RIM’s volatile stock certainly shows! – but it actually makes perfect sense when considering Disruption Theory.

Disruption takes time. It’s a process, typically over a multi-year (and in some cases, multi-decade) period. The financial statements could be highly misleading during this period. For RIM, its profits kept increasing, while iPhone and Android were gaining traction and 4G networks were being built. The rising earnings – and compressed price-to-earnings multiple – seemed attractive for value investors. The value crowd, dismissive of the competitive dynamic and encouraged by the fundamentals, was able to support the stock for some time. Until the earnings themselves vanished.

A friend of mine uses the Wile E. Coyote analogy for these disruption cases: RIM’s moat had been compromised, and yet its stock kept running forward – past the end of the cliff – for a few more quarters; eventually, however, the investors had to look down, and the stock fell off the cliff.

Disclosure: I own shares of Alphabet, and may sell without warning. Nothing here is investment advice.

The 2008-09 Financial Crisis, and the ensued market recovery, also contributed to the volatility of course.

Technically speaking, the iPhone disrupted personal computers; the BlackBerry demise was a side effect that can be better described as Obsoletion (as explained in Stratechery).

Oprah Winfrey included different BlackBerry models in her 2003 and 2005 “Favorite Things” holiday list, which boosted sales.

His BlackBerry device helped in shaping Obama’s image as a man of the people, connected to the younger generation, during the 2008 elections; he famously pushed back on the request of the Secret Service that he stop using his BlackBerry phone once in office.

Rightfully earning the phone its notorious nickname, the shitstorm.

Really interesting read! I hope I am not holding the RIM stock of this generation haha