Right about the Future, Wrong about the Stock

Being right about a secular trend is not enough: an important investing lesson from the telecom industry.

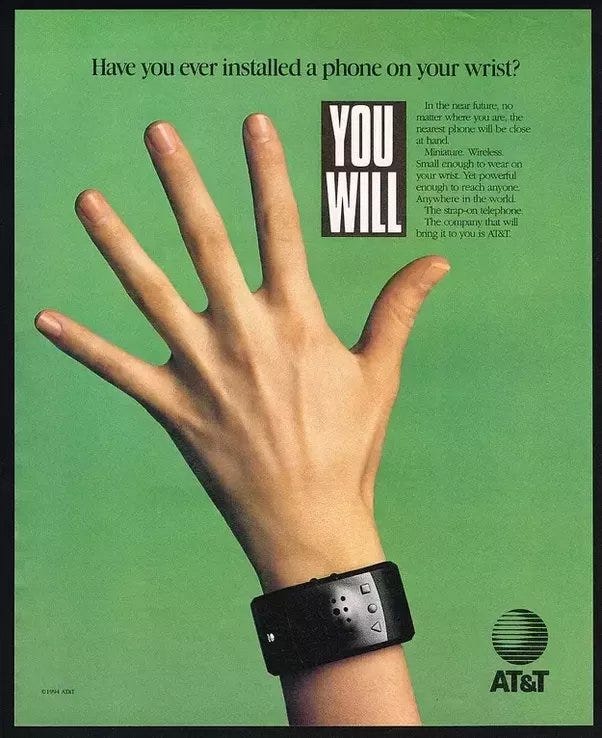

Have you ever watched the movie you wanted to, the minute you wanted to?

Learned special things from far away places?

[…] Have you ever kept an eye on your home when you're not at home,

or gotten a phone call on your wrist?

You will.

And the company that'll bring it to you is AT&T.

It’s quite incredible that all these fantastic futuristic predictions, made by the 1993 AT&T “You Will” ad campaign, have actually materialized; also, it is AT&T that is delivering these capabilities – through an infrastructure that was hard to imagine back in 1993 – to almost 120 million US wireless subscribers. And yet, an investor who bought – based on this vision – AT&T stock when these ads ran1, would have turned out correct about the future, but alas, would have significantly underperformed the overall market.

While AT&T isn’t considered a hot tech company today, the Telephone Company has been a highly profitable monopoly throughout most of the twentieth century, and – alongside IBM – was at the cutting edge of the tech industry for several decades.

It’s astonishing to go back and watch these ads, thirty years later; all of the futuristic promises – buying concert tickets from a machine, sending text messages from the beach, or joining a video conference while being barefoot in the park – are now simply considered part of everyday life. Mostly thanks to our smartphones.

Smartphones enable these magical use cases partly thanks to incredible progress in wireless communications, and to huge amounts of capital spent on infrastructure buildout by AT&T and the rest of the industry.

Unlike investors in Netscape, Yahoo or AOL – who may have been correct about the internet transformation but failed to identify the companies that would survive – early-1990s investors in AT&T have nailed down both the general trend and a company that actually survived to become a key part of said trend. They must have been rewarded for this smart call. Right?

Well.

Not exactly.

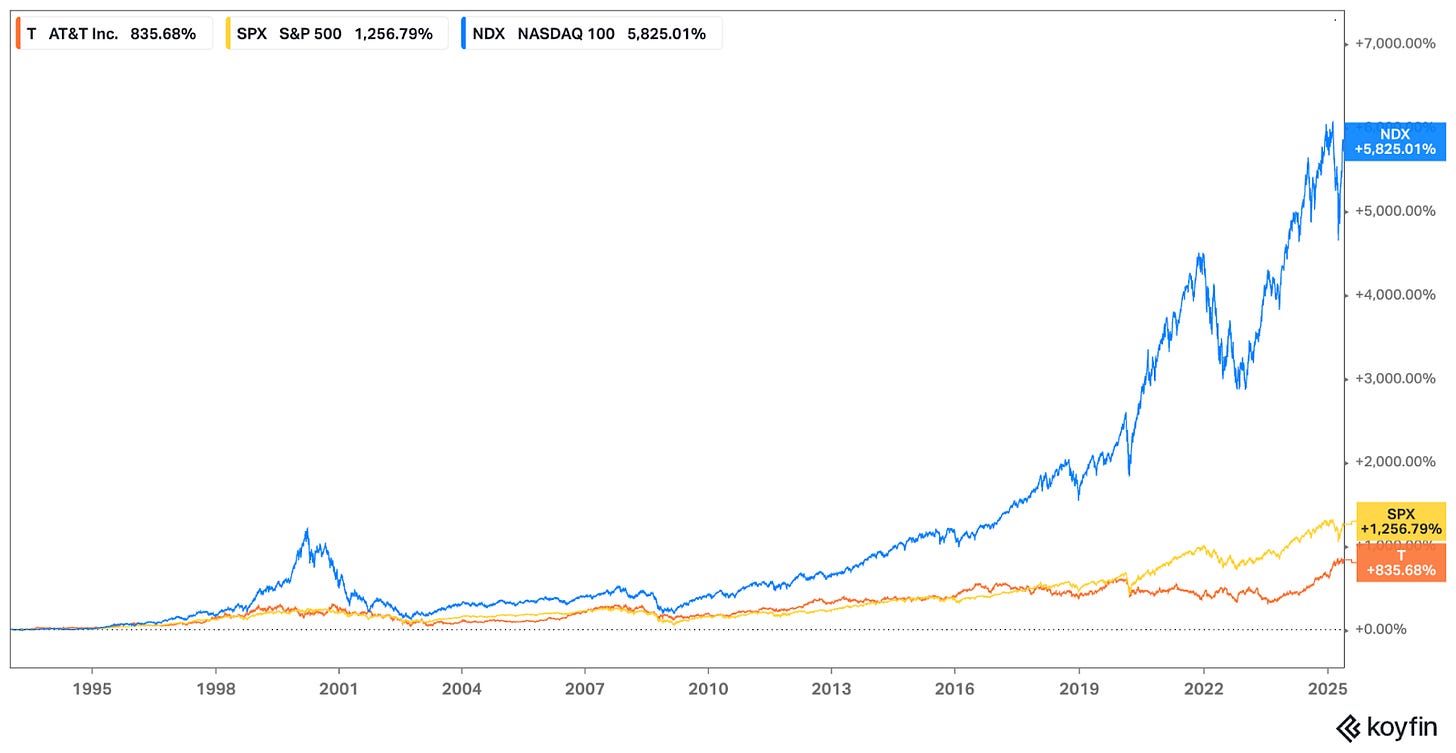

An investor who bought AT&T shares in 1993, believing the company could eventually deliver on its “You Will” vision, earned a total return of 835.68% over 32 years. Not great when considering the overall market however, as the S&P climbed 1,256.79% during the same period. Even worse: the NASDAQ – the index that contains the tech companies that actually profited from the internet revolution – gained an amazing return of 5,825%.

In other words: $1,000 invested in AT&T in 1993 became $9,356.80.

That same $1,000 invested in the S&P 500 would have turned into $13,567.90.

And the NASDAQ would have returned $59,250.

It almost feels unfair! Our hypothetical investor was correct about what the future was going to look like, and all the use cases that the internet was about to enable; they were also right about the fact that AT&T would take a meaningful part in that future, and yet – they made a lousy return compared to the overall market.

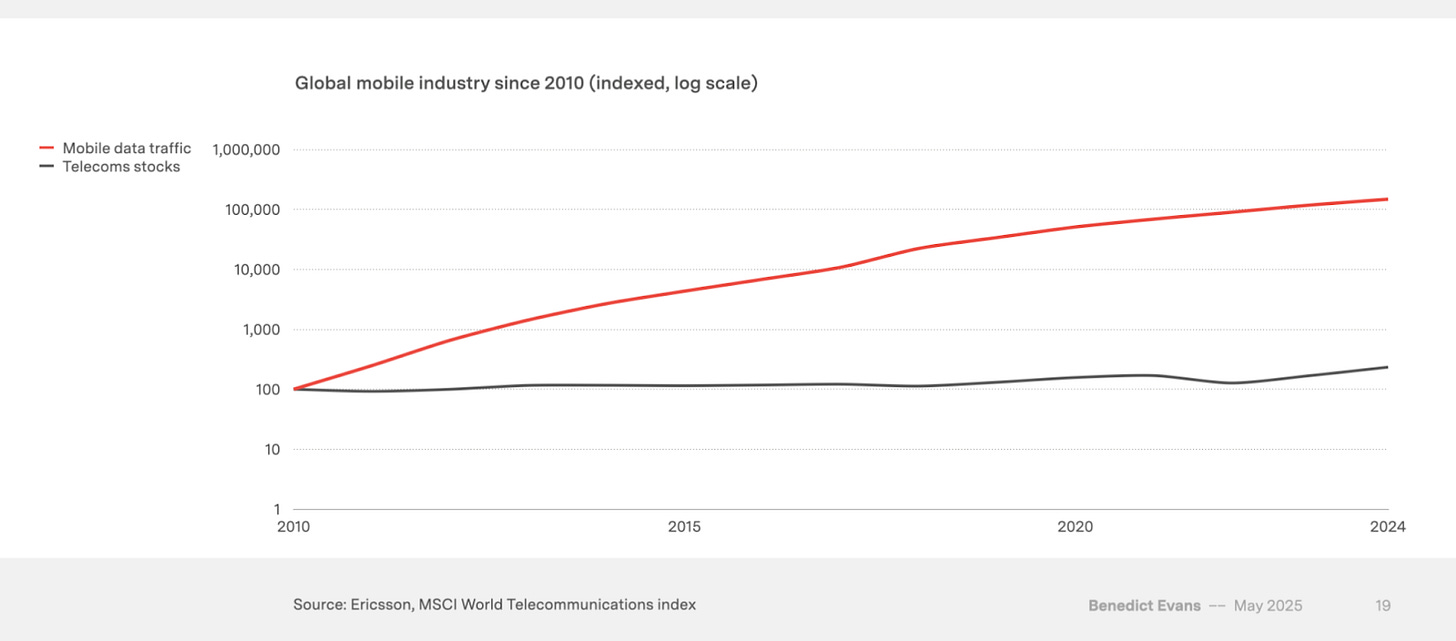

The reason – and what our investor missed – is that AT&T did not get to capture a significant portion of the value that was being created. And it’s not because AT&T was disrupted by another telecom provider – they all failed to capture value generated by the internet explosion, as this chart from Benedict Evans’ recent presentation so bluntly illustrates:

Telecom stocks have been lagging, despite mobile data traffic growing by roughly 1000x over the last 15 years. AT&T spent many billions of dollars building out its 3G, then 4G, and later 5G infrastructure; without that buildout, we would not have been able to join meetings from the beach or answer phone calls on our wrist. And yet, there isn’t much differentiating AT&T from Verizon or T-Mobile. Consumers simply look for the cheapest way to connect their iPhone online. A significant portion of the value that was created by the smartphone revolution has accrued to Apple.

The integrated iPhone, which kept getting better and better, unbundled the carriers’ attempts at selling high-margin services; remember when ringtones made $1.3B in 2007? Then the iPhone launched, allowing anyone to download whatever ringtones they wanted directly from the internet. No need to buy one from your mobile service provider. And besides, who cared about their ringtone once iMessage offered unlimited texting, and everyone stopped calling each other.

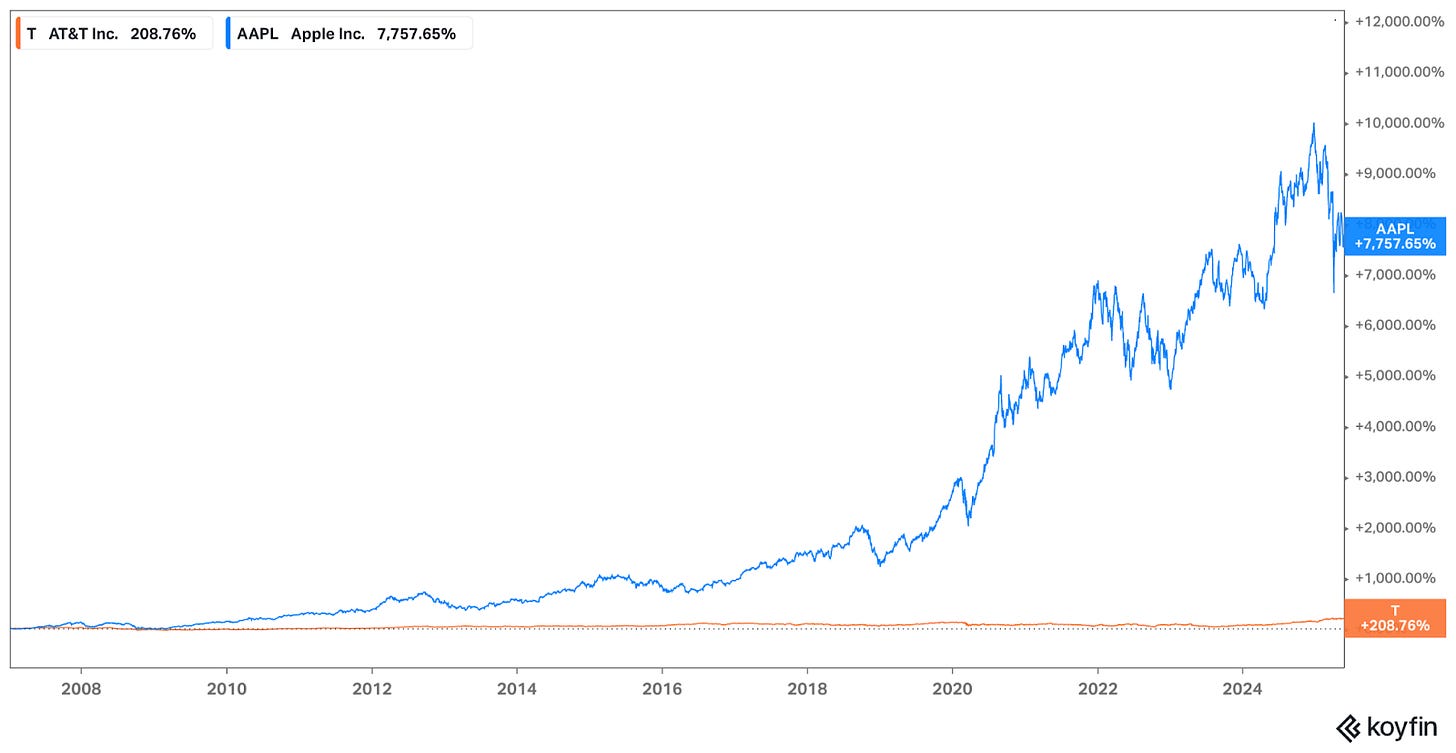

The above chart didn’t include Apple – still a struggling computer maker back in ‘93 – since the meteoric rise of its stock would have dwarfed the index. Think of the investor who, following the 2007 iPhone announcement – initially launched exclusively for AT&T customers – correctly envisions its incredible success, but invests in AT&T as some kind of pure play, a more sophisticated way to benefit from it. Because it had a lower multiple, or offered more hedging, or whatever.

The current context is investors searching for AI exposure, but feel like they have already missed Nvidia. So they invest somewhere else along the value chain; in a semiconductor manufacturing vendor for example, or a data-center energy company, one that presumably stands to benefit from the AI boom. That company may take an active role in the AI value chain for another decade or two while the AI expansion marches on, and yet – the same investment might underperform the market.

Investing in emerging technological revolutions is hard: one must (a) be right about the timing (investing in internet stocks in 1999 vs. 2007), (b) bet on a company that actually survives (AOL or Yahoo seemed like winners in the early 2000s), and, on top of that – (c) figure out where value is going to be captured. The last one can be tricky, and that’s what you’ve probably missed if you invested in the Telephone Company when the iPhone arrived.

The above is for educational purposes only; not investment advice. I am not an investment advisor, these are just my opinions and thoughts.

The vision was probably for AT&T to also build the phones through which these things got done. While that specifically did not happen, AT&T still remains a key player in the mobile industry. And yet, it didn’t earn anything near what Apple has made.

בהחלט.