Could Wix Successfully Disrupt Itself?

On Vibe Coding, the Base44 acquisition, and how despite ongoing skepticism, Wix is determined not to be killed by AI but rather benefit from it.

Wix stock is soaring, on reports that explosive momentum gained by its recently-acquired AI app builder Base44 is already driving an overall revenue growth acceleration for Wix.

Wait, hold on a second.

Did I say the stock was soaring?

Oh. That’s not true. I’m sorry.

The stock is actually crashing!

Down 20% on the day the earnings report came out last month.

Completing over a 60% drawdown from its January highs.

My bad.

But I did get the accelerated revenue growth part right. So I guess it’s kind of puzzling!

Here is what happened -

Vibe Coding and Base44 In Public

One incredible thing about Base44 was its timing: Maor Shlomo started building it in October 2024, just over a year ago, and one month after OpenAI o1 – a breakthrough reasoning model – was announced. Inference-time compute turned out to be the critical piece that finally made AI-generated coding work. It was virtually impossible to build a tool like Base44 prior to the existence of reasoning models, and a few months later – Shlomo would have already been too late. The term Vibe Coding was coined by Andrej Karpathy in February 2025 to describe the wildfire adoption of LLM-generated software.

Multiple AI app builders – such as Replit, Bolt and Lovable – were gaining traction in late 2024, and this is exactly when Shlomo chose to post this tweet:

By February 2025 – the same month that Karpathy’s vibe coding tweet was going viral – solo-founder Maor Shlomo posted this on LinkedIn:

[…] Base44 is a moonshot experiment - helping everyone, technical or not, build software without coding, at all.

For the past decade or so - I’ve been obsessed with the idea of what possibilities will open up if everyone can build their own tools or apps - and lately it’s seemed feasible enough to take a shot at it.

It’s not the first tool aiming to allow people to build software using natural language,

But we’re taking what I think is a very different and opinionated approach -

Every app in Base44 is created with a built-in DB, storage layer, authentication, analytics and countless integrations… or as our users like to call it - “batteries included” […]

This was an instant hit: by March, Shlomo shared that the company crossed 20k customers and was already profitable. In April Shlomo told TrashTech podcast that Base44 had over 150k subscribers, and that it had reached $1M in ARR within three weeks of launching. In June, 4-months old Base44 was acquired by Wix for $80M (more on that later).

Its perfect timing wasn’t the only reason for Base44’s massive success: it required relentless execution from Shlomo, who – on that same podcast – mentioned not sleeping more than a few hours in a row for months. Moreover, building in public – through constantly sharing his progress on LinkedIn – turned out to be a brilliant marketing strategy: the posts would regularly go viral, creating buzz and awareness for Base44 at virtually no cost. Shlomo gained a lot of traction especially within the Israeli tech community, many of whom became fans rooting for his success, and offered help and support along the way.

It’s fun to go back and scroll through this well-documented journey on LinkedIn. Even the fact that these posts feel AI-generated is an advantage in this case. “This guy sure knows how to get stuff done with AI,” is what crosses my mind when I read them. Which leads to another crucial element of Base44’s success: it’s all the way at the cookie-cutter end of the Vibe Coding Smiling Curve: the architecture choices – how to configure and integrate the different modules that make up the software system – are pre-determined; this approach offers less degrees of freedom, but makes it so much easier to build decent apps, fast. Batteries Included, as Maor Shlomo refers to it. Avid readers may recall that a friend of mine built an expense tracking app, with Base44, while in line to board a plane.

This is also part of what makes Wix and Base44 fit so well together: in addition to the natural cultural fit based on the founders having very similar backgrounds (both entrepreneurs served at the same Israeli intelligence tech unit as Check Point founder Gil Shwed), both companies have gained their initial traction by leaning into the same “batteries included” approach. Wix first launched its website builder in 2008, and within roughly 5 years reached $100M in revenue run-rate (this was considered fast back in the early days of SaaS!); that success was rooted in the streamlined self-service experience that – unlike the WordPress alternative – relieved business owners from dealing with any coding or deployment or maintenance considerations. At the same extreme of the smiling curve as Base44.

Wix and The Bitter Lesson

Wix was labeled an AI loser as early as May 2023, when its stock tumbled on concerns that it was going to be disrupted by then-six-months old ChatGPT. The trigger was Chegg, whose college-student subscribers were replacing its service with simply asking ChatGPT to solve their homework. Why couldn’t you also ask your AI chatbot to generate a landing web page for your business, investors began to wonder; in response, Wix founder and CEO Avishai Abrahami took it to LinkedIn, arguing that AI was indeed revolutionary, but was only going to improve Wix’s offering, not displace it; in the Clayton Christensen jargon, it was going to be a sustaining technology:

Is AI a disruption in the website industry? Yes it is, and we are such great believers in the technology, that we launched our first AI website creator back in 2016 [...]

AI will make Wix better [...]

Am I worried that AI is going to take over website building?

The short answer is no. AI has tremendous value in website creation. But it does not substitute the software needed to manage someone’s entire business online. The Wix platform has evolved into a comprehensive business management solution that not only allows our users to design their website, but also manage their entire business online.

So can’t AI do all that?

A website is a lot more than just text and images. A website is an integrated software platform with millions of lines of code, functionalities like eCommerce, appointments, selling tickets, blogs, and so much more. On top of that, everything has to work together - the databases, CDN, the transactions, privacy and of course complex security mechanisms.

The key arguments Abrahami made in his 2023 post were that (1) the “websites” generated by Wix are actually complex software platforms that AI couldn’t create on its own (which was actually correct at that point in time), and (2) AI presents an opportunity to reduce friction and streamline the website creation workflow. The Studio, launched by Wix in August of 2023, was a great demonstration of the latter. I liked this tutorial, which demonstrated how well generative AI was weaved into different steps – such as writing a description paragraph for your business – saving the need to switch tabs and crafting prompts to ChatGPT. This was fairly advanced at the time.

By the end of 2023 Wix was already considered an AI winner; its stock soared 220% from the May 2023 lows, peaking around $240/share in early 2025. Right around the same time when Base44 first launched and Karpathy’s Vibe Coding tweet went viral. The implication for Wix was yet another example of the pattern Rich Sutton had named as The Bitter Lesson in 2019:

The biggest lesson that can be read from 70 years of AI research is that general methods that leverage computation are ultimately the most effective, and by a large margin. The ultimate reason for this is Moore’s law, or rather its generalization of continued exponentially falling cost per unit of computation. Most AI research has been conducted as if the computation available to the agent were constant (in which case leveraging human knowledge would be one of the only ways to improve performance) but, over a slightly longer time than a typical research project, massively more computation inevitably becomes available. Seeking an improvement that makes a difference in the shorter term, researchers seek to leverage their human knowledge of the domain, but the only thing that matters in the long run is the leveraging of computation [...]

The Wix Studio – launched merely 9 months following the arrival of ChatGPT – was an example of leveraging “human knowledge of the domain” to “seek an improvement that makes a difference in the shorter term”; over the long run however, as The Bitter Lesson would suggest, “what mattered was the leveraging of computation”. And that long run arrived rather quickly, as reasoning models were introduced roughly a year following the Wix Studio launch, and Vibe Coding was made possible; instead of subtly integrating AI into different parts of the workflow, a single AI prompt could replace the entire workflow; the argument made by Abrahami in 2023 – “AI can’t do everything that Wix does, and is not going to take over website building” – was no longer valid.

Wix and Base44

To Wix’s credit, the mistake was recognized rather quickly; not quickly enough to have launched their own AI app builder as early as October 2024, but it is impressive how early they snatched Base44. From a Wix press release dated June 18, 2025:

Today Wix announced its acquisition of Base44, an AI-powered platform that enables anyone to create fully-functional, custom software solutions and applications using natural language, without the need for traditional coding. The acquisition adds a powerful new arm to Wix’s AI portfolio, expanding its suite of intelligent solutions that empower anyone to build and grow online.

[...] Base44 will continue to operate as a distinct product and business, maintaining its unique identity and momentum while benefiting from the scale and support of Wix.

Under the terms of the agreement, Wix acquired Base44 for initial consideration of approximately $80 million plus additional earn-out payments paid through 2029 predicated upon certain performance metrics.

This seemed like a brilliant move by Wix: paying $80M for a startup in a category where companies (such as Lovable, Replit, Vercel and Windsurf) were already valued in billions of dollars1. Paying less than 1% of its market cap at the time, it seemed like Wix was again transforming itself from being threatened by AI, to a company benefitting from it.

The decision to sell, Shlomo explained on the Startup for Startup podcast last July, was partly driven by the fact that his viral building-in-public posts – which had fueled Base44’s growth – were hitting a ceiling; since he couldn’t figure out how to use paid marketing effectively, the VC route didn’t seem to make sense. Wix, however, has been mastering direct online marketing for almost 2 decades2. Aiming the full force of Wix’s powerful marketing machine at Base44 unleashed a hockey-stick growth:

Within less than six months, Base44 grew from 1% share to 11% of the Vibe Coding market (according to SimilarWeb), and surpassed Replit in website traffic.

On the recent earnings call, Wix mentioned “at least $50M in ARR” as the yearend expectation for Base44; they might be sandbagging, as the $100M figured was already mentioned by the 20VC podcast when interviewing Shlomo recently. This is quite an achievement for a 10-month old product3. And a tremendous deal for Wix, who effectively paid 1x ARR (plus earn-outs) for a company with peers trading at 30x revenue multiples. Just last month, Wix President and COO Nir Zohar, mentioned on X that of the booming AI-coding companies, “ the only one that is accessible to public market investors is Base44”; early Wix investor and former director Michael Eisenberg even went on to compare it to Google’s acquisition of Youtube.

Which leads us back to the beginning of this post: Wix’s vibe coding success is exceeding expectations, and yet the stock – for some reason – collapsed in response.

Wix and Disruption

Wix actually gave the market some very good reasons for worrying; after painting a bright yet abstract vision around the vibe coding opportunity, management turned to draw – with painstaking detail – the gloomy reality of its present financial impact. CFO Lior Shemesh started with the positive news – a higher-than-expected revenue contribution from Base44, and raising the full year revenue guidance by roughly 1% – but then reported the following on to the cost side:

Turning to the cost side. We recognized our first full quarter of costs associated with BASE44. Before getting into the details, I’d like to start by explaining the business dynamics of BASE44, which differs from core Wix. As Nir discussed, we are seeing top line growth for BASE44 trend above our initial expectations. The very large majority of these users are on monthly subscription plans, a stark contrast to the more than 80% of Wix’ mix attributed to annual or longer duration plans. This translates into a linear bookings dollar trajectory for BASE44 compared to Wix’ front-loaded bookings behavior. As a result, most of BASE44’s bookings are expected to come in future quarters as these monthly cohorts build and renew. However, the costs associated with these BASE44 users are impacting our financials today. This misalignment between bookings and operating expenses is resulting in a short-term headwind to our free cash flow.

We also anticipate a short-term headwind on operating profit as we incur startup costs and initial growth investments for BASE44, while revenue ramps, but remains insignificant to our top line today, the 2 areas we see the most impact are cost of revenue and sales and marketing. On the cost of revenue side, we are incurring AI processing and compute costs to support ramping BASE44 demand. These costs tend to be front-end heavy as new users consume more AI tokens during their initial build phase. These expenses offset continued AI-driven productivity efficiencies across the customer care organization and improved Business Solutions gross margin. As a result, total non-GAAP gross margin in Q3 was 69%, down slightly from 70% in Q2 as expected.

On the sales and marketing side, third quarter non-GAAP sales and marketing expenses increased 23% sequentially as we built and deployed the marketing strategy for BASE44. This is a result of accelerated branding and acquisition marketing investments above our initial August plan to capture stronger-than-expected demand, particularly in the back half of the quarter. I’m very encouraged by BASE44’s TROI, especially so early on, a signal of sustained user strength that isn’t fully reflected in the P&L due to the monthly mix dynamic. We also saw a slight increase in non-GAAP R&D expenses, which were up 7% compared to the second quarter as a result of higher overhead, AI and other expenses as planned.

As a result, non-GAAP operating income was $90 million or 18% of revenue in the third quarter. This excludes $35 million of acquisition-related expenses primarily earn-out payments for the BASE44 team. We expect earn-out payments to continue to trend upwards as BASE44 ARR approaches the high end of its lofty previously set performance target.

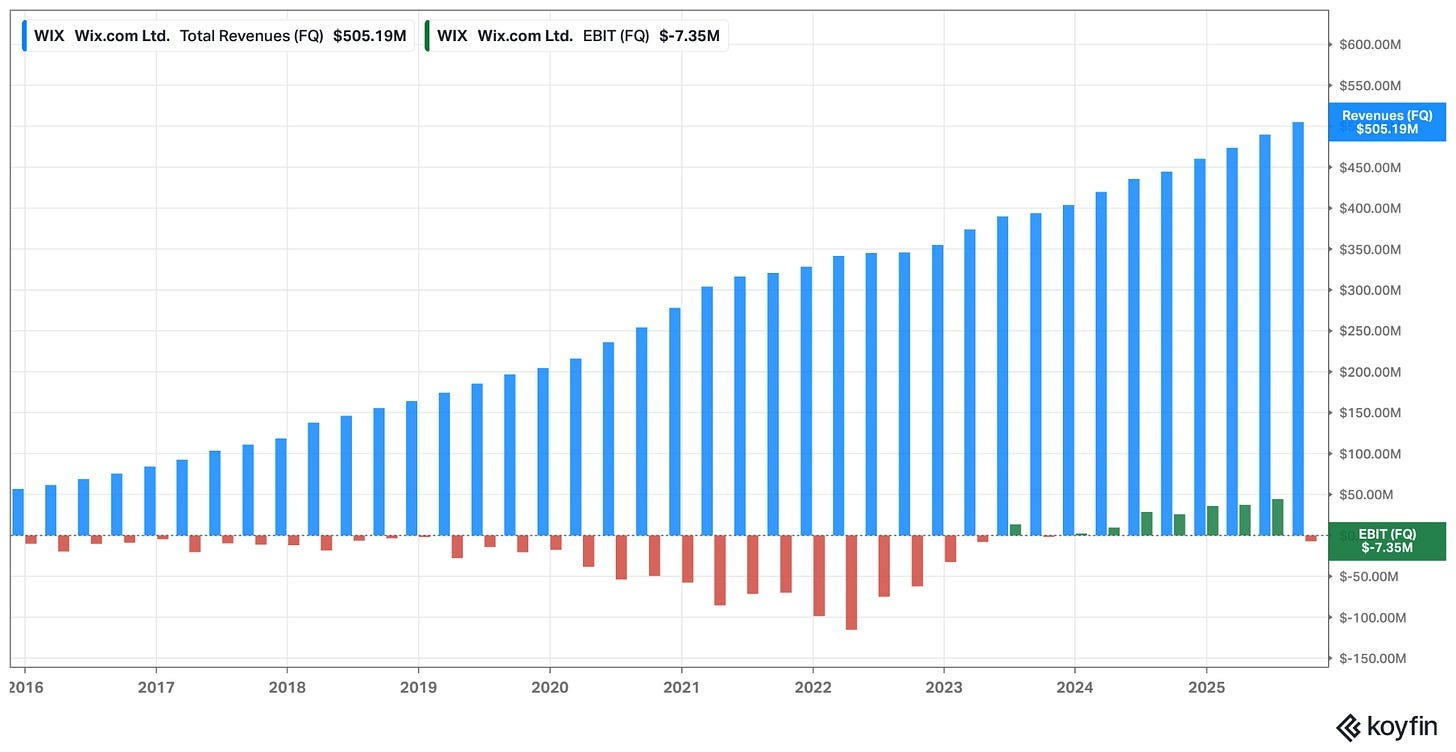

To sum up: the couple of extra revenue percentage points provided by Base44 comes at a steep cost: depressed gross margins, increased R&D costs, and a ballooning marketing spend. For the first time since 2023 – when it recovered from its Covid hangover – Wix moved into a negative EBIT territory. And the trend is only expected to accelerate: the team is incentivized to push as hard as they can on Base44 growth, and collect additional earn-out payments as they are driving down Wix’s margins.

The Q&A session started with a concern about Base44 churn rates, whether Wix expects them to go down, and isn’t that essentially just a prototyping platform. Abrahami didn’t provide a concrete churn metric (which is probably very high), and explained that while there are things to do on the cost reduction front, it is not a priority at this point. Wix is focused on grabbing market share4.

That was probably enough for the market to conclude that while Wix’s legacy business is decaying, its new business is a money-burning machine, and it is only going to get worse from here. Why wouldn’t the stock tank?

The irony is that if Wix never acquired Base44, its stock price would likely be higher! In this parallel universe, Wix would have simply – much like Gillette in its initial reaction to Dollar Shave Club (see previous post) – ignored the new competitive threat. Kept on dismissing it as a “toy app generator”. That is how an incumbent typically responds, and the way the stock market has been treating Wix illustrates why that is the case.

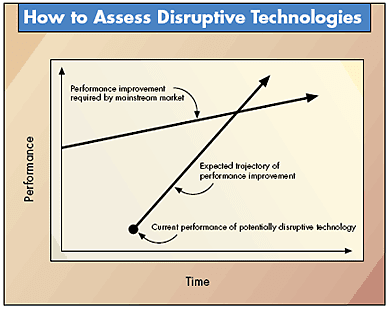

To go back to Prof. Clayton Christensen’s seminal graph illustrating what are Disruptive Technologies – the upper curve represents the core Wix website building business: highly predictable, mature, stable, and profitable; yes, there is a meteor coming its way, but it hasn’t hit yet.

The bottom curve represents an AI tool like Base44: starts at a much lower base, the economics aren’t there yet, some key parts are missing, some rough edges to polish, but it represents a tremendous growth opportunity that would eventually eclipse the core business.

From a section titled “Disruptive Technologies versus Rational Investments” in The Innovator’s Dilemma:

The last element of the failure framework, the conclusion by established companies that investing aggressively in disruptive technologies is not a rational financial decision for them to make, has three bases. First, disruptive products are simpler and cheaper; they generally promise lower margins, not greater profits. Second, disruptive technologies typically are first commercialized in emerging or insignificant markets. And third, leading firms’ most profitable customers generally don’t want, and indeed initially can’t use, products based on disruptive technologies. By and large, a disruptive technology is initially embraced by the least profitable customers in a market. Hence, most companies with a practiced discipline of listening to their best customers and identifying new products that promise greater profitability and growth are rarely able to build a case for investing in disruptive technologies until it is too late.

Christensen’s theory would suggest that a company like Wix – through responsible and logical analysis – would deem Base44 as a waste of resources, and instead make the responsible decision of milking whatever cash is still left to be made by its legacy business; the stock market would have probably preferred that. That, though, would turn out to be a mistake, when the vibes of AI coding catch up and disrupt the core Wix business. At that point, it would be too late for Wix to adopt the new paradigm, and it would remain fighting to survive and slow down the decay of its once-thriving business.

The key difference, however, is that Christensen’s seminal article is 30 years old, and everyone knows about disruption by now. Embracing new technologies has become a natural instinct, and managers don’t need academic papers to justify doing so. And still, I am impressed by the way Wix has been navigating this situation.

Wix, presumably, had already “embraced AI” even before the emergence of vibe coding: Generative AI was well-weaved into its 2023 Studio. But instead of a Ballmer-like (“haha the iPhone costs $450 and doesn’t have a keyboard”) response, along the lines of “it wastes so many tokens and doesn’t support e-commerce yet” – they made the leap early enough.

It probably helps that Wix is still founder-led, with a healthy appetite for growth initiatives (sometimes even too much growth appetite – a topic for another post). The current management could probably sustain the stock market headwinds, and keep investing behind Base44, even while its financials don’t make much sense.

Does this necessarily mean a bright future for Wix though?

We can’t really tell at this point!

Unlike the wide moat protecting Wix’s core (soon to become legacy) business, Base44 operates in a highly crowded and uncertain environment. While Wix has to answer margin-related questions posed by analysts every three months, its vibe-coding competitors are funded by Venture Capitalists who demand growth at all costs. It’s still early to guess who is going to win. There might even be more bitter lessons, a new wave that would wash over the entire category and deem the current tools as irrelevant. What role do web app builders even play in a world with UI being generated on the fly, tailored for impromptu user interactions?

While it’s hard to predict how Wix is going to come out on the other side of the AI tornado, it’s a fascinating journey to watch. The only prediction I could confidently make at this point is that its stock continues to be volatile along the way.

Disclosure: not financial advice, this post is for educational and general purposes only and should not be relied upon for investment decisions.

“$80 million plus additional earn-out payments,” to be exact.

Wix has pioneered the practice of operating a direct online marketing at scale, while being headquartered in Israel; the knowledge spill over enabled several other Israeli companies to follow its footsteps.

With the caveat that “AI ARR” figures should be treated with healthy skepticism due to high churn, as MBI Deep Dives already explained back in July.

Abrahami did insist that real commercial applications – not just prototypes – could already be built, and fully functional websites – the kind traditionally generated by Wix – could also be generated with AI by early next year.

$WIX Is going get acquired by Google soon. Base44 which WIX owns already have free access to nanobanana which google owns. https://x.com/MS_BASE44/status/2000602754885243171

I think an acquisition by Google for WIX is doing soon, that is why the stock price is supressed even after good earning. WIX's price action looks like linkedin before acquisition. Google wants to buy WIX for cheap so got the institution to dump the stock so they can buy it up in the dark pools. After the accumulation is done the price is going to jump to its offer value which is WIX's fair value $203 + some premium.